tax benefit rule calculation

The tax benefit rule only applies if there is a tax benefit. If a section 83i election.

.png)

Deductions For Vacant Land Australian Taxation Office

Payment rate is given based on.

. The rule is promulgated by the Internal Revenue Service. Family Tax Benefit is paid to parents having children under age 19 and full time dependent student under 22. So if you owed 1500 in taxes and then took a 1000 credit your tax bill would be 500 1500 - 1000.

15000 2275 144750 de minimis threshold The calculation above that the de minimis threshold is 147750. What is the Tax Benefit Rule. The tax benefit shown in the summary section is defined by the following equation.

Individual Income Tax Return or Form 1040-SR US. OECD Home Directorate for Employment Labour and Social Affairs Social policies and data Benefits and wages Tax-benefit web calculator. Example A couple paid 4000 in state taxes in.

The TAB is calculated by using a two-step procedure. That results in a 400 difference which is your tax benefit. This tax worksheet calculates whether an individuals state income tax refund is taxable in the year after the states income taxes were paid.

Now the business will get a benefit of 50 of the amount expended on this machinery which comes to 5000. Example of the Tax Benefit Rule. But from 1st January 2022 they can claim nil provisional ITC.

Therefore the total income that is taxable will be 115000-5000 110000. Calculation of net profit of self-employed earners. Family Tax Benefit Calculator Australia.

Dividing this by the marginal tax rate for regular tax purposes 28 results in 646 the approximate amount of income taxes that did not produce a tax benefit. The tax credit reduces your tax bill by that same 1000. Year 1 interest paid year 1 property tax paid- if marked as deductible year 1 MI paid- if.

This will give you an estimate of. This means that in the year the money was listed as a deduction the taxpayer wound up paying less tax as a direct result. The tax benefit rule states that if a deduction is taken in a prior year and the underlying amount is recovered in a subsequent period then the underlying amount must be included in gross income in the subsequent period.

Lets say the machinery cost in this case is 10000. Of state income tax in 2018 Cs state and local tax deduction would have been reduced from 10000 to 9500 and as a result Cs itemized deductions would have been reduced from. The interest paid on education loan availed can be considered as a deduction from the total income US 80EThe Tax Benefit Calculator given below is an illustration on the Tax Benefit US 80E.

If the full 5000 refund. You can use an independent free and anonymous benefits calculator to check what you could be entitled to. However under the tax benefit rule the taxpayer must only include the refund up to the amount by which the deduction taken.

If that deduction wasnt taken you would have claimed the 12600 standard deduction. In some cases this will not have been the case. Your tax benefit is the difference between the 12600 deduction you would have claimed without the state tax deduction versus the 13000 you actually claimed.

For federal income tax purposes the employer must withhold federal income tax at 37 in the tax year that the amount deferred is included in the employees income. A rule that provides that the amount of an expense recovered must be included in income in the year of the recovery to the extent the original expense resulted in a tax benefit. The benefits you could get.

Tax Benefit Calculator Education Loan from Axis Bank helps you to finance higher education and save tax too. Dividing this by the marginal tax rate for regular tax purposes 28 results in 646 the approximate amount of income taxes that did not produce a tax benefit. For example a taxpayer listing a deduction may have earned so little they wouldnt have paid tax anyway.

With the figure we can determine which form of tax is.

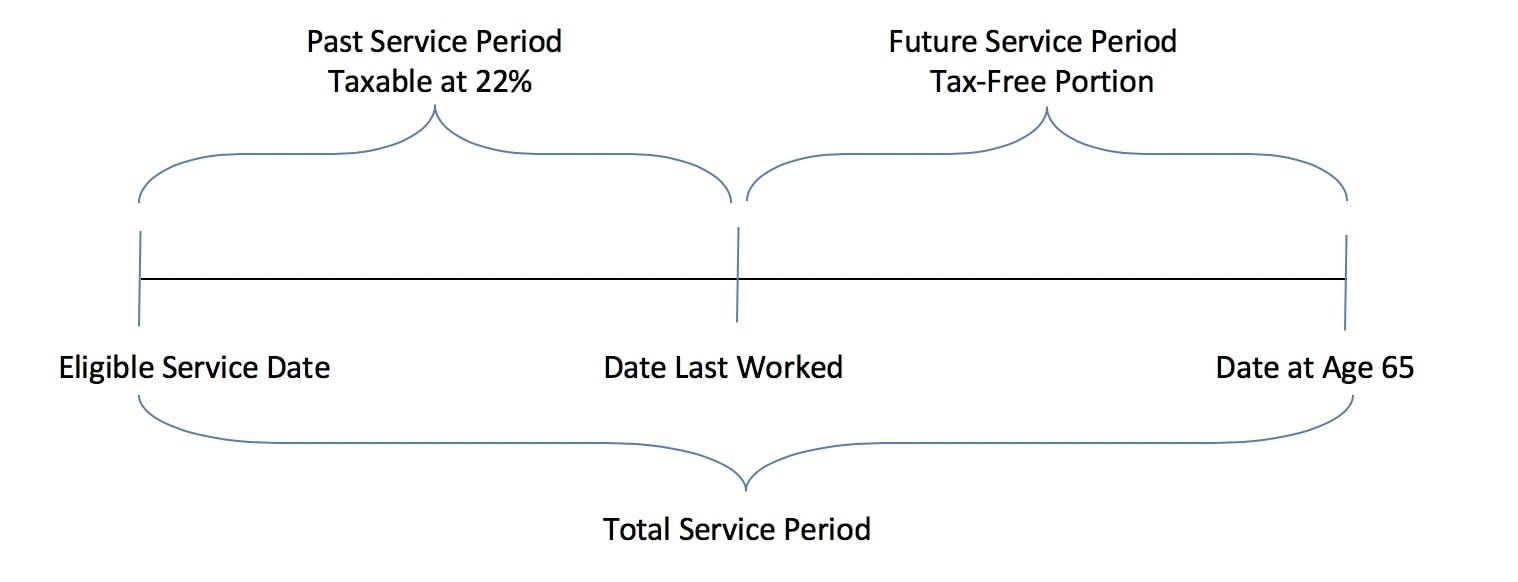

Tpd Tax Calculator Minimise Tax On Payouts Save Money

Taxable Income Formula Examples How To Calculate Taxable Income

Tax Shield Formula Step By Step Calculation With Examples

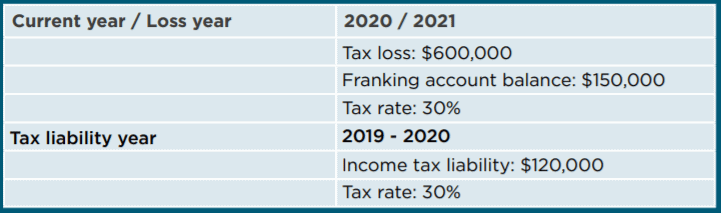

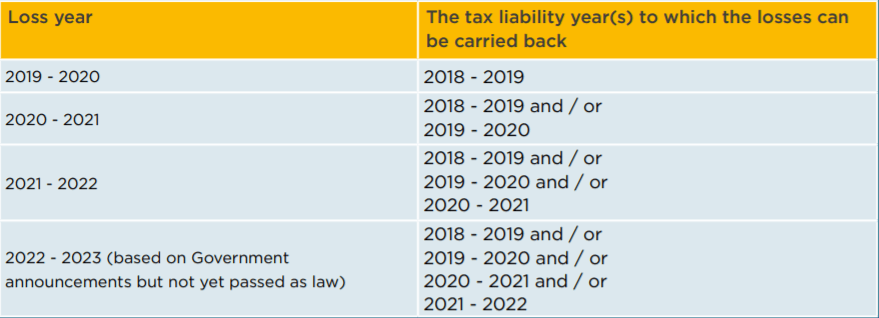

The Loss Carry Back Tax Offset Explained Hlb Mann Judd

How To Calculate Income Tax In Excel

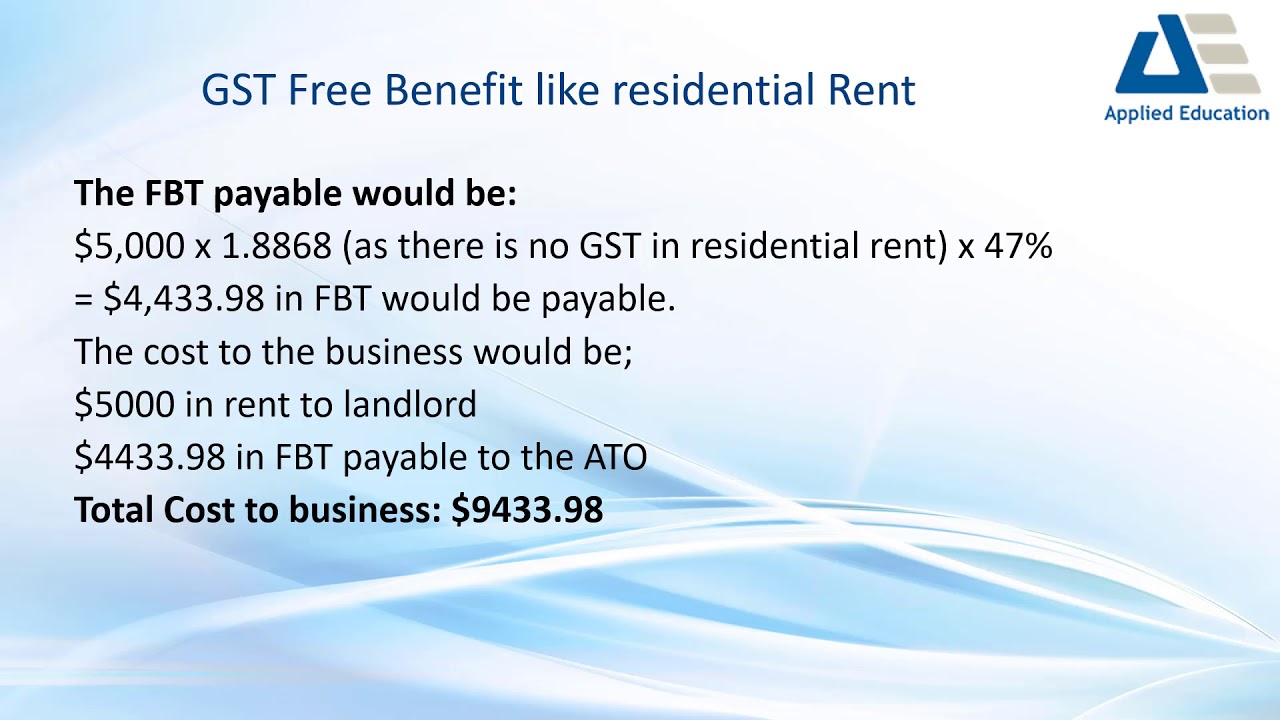

What Is Fringe Benefits Tax Fbt And How Is Fbt Calculated

The Loss Carry Back Tax Offset Explained Hlb Mann Judd

How To Calculate The Break Even Point

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Formula Step By Step Calculation With Examples

/not_for_profit_nonprofit_charity_AdobeStock_93906620-2ce63147cc814bd3b25984ee637c3bac.jpeg)

Charitable Contributions Tax Breaks And Limits

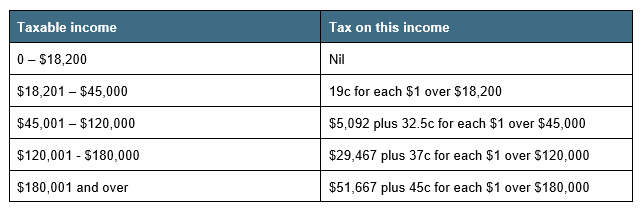

Australian Income Tax Brackets And Rates 2021 22 And 2022 23

Interest Tax Shield Formula And Calculator Excel Template

End Of Financial Year Guide 2021 Lexology

Accounting For Income Taxes Under Asc 740 An Overview Gaap Dynamics

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

Your Ultimate Australia Crypto Tax Guide 2022 Koinly

Taxable Income Formula Examples How To Calculate Taxable Income